Fraud Center

UNCLE Credit Union is dedicated to the safety and security of our members.

Our Fraud Center is dedicated to safeguarding your financial well-being by providing educational tools and resources you need to protect yourself against scams, identity theft, and fraudulent activity.

Click the menu items below to find more information:

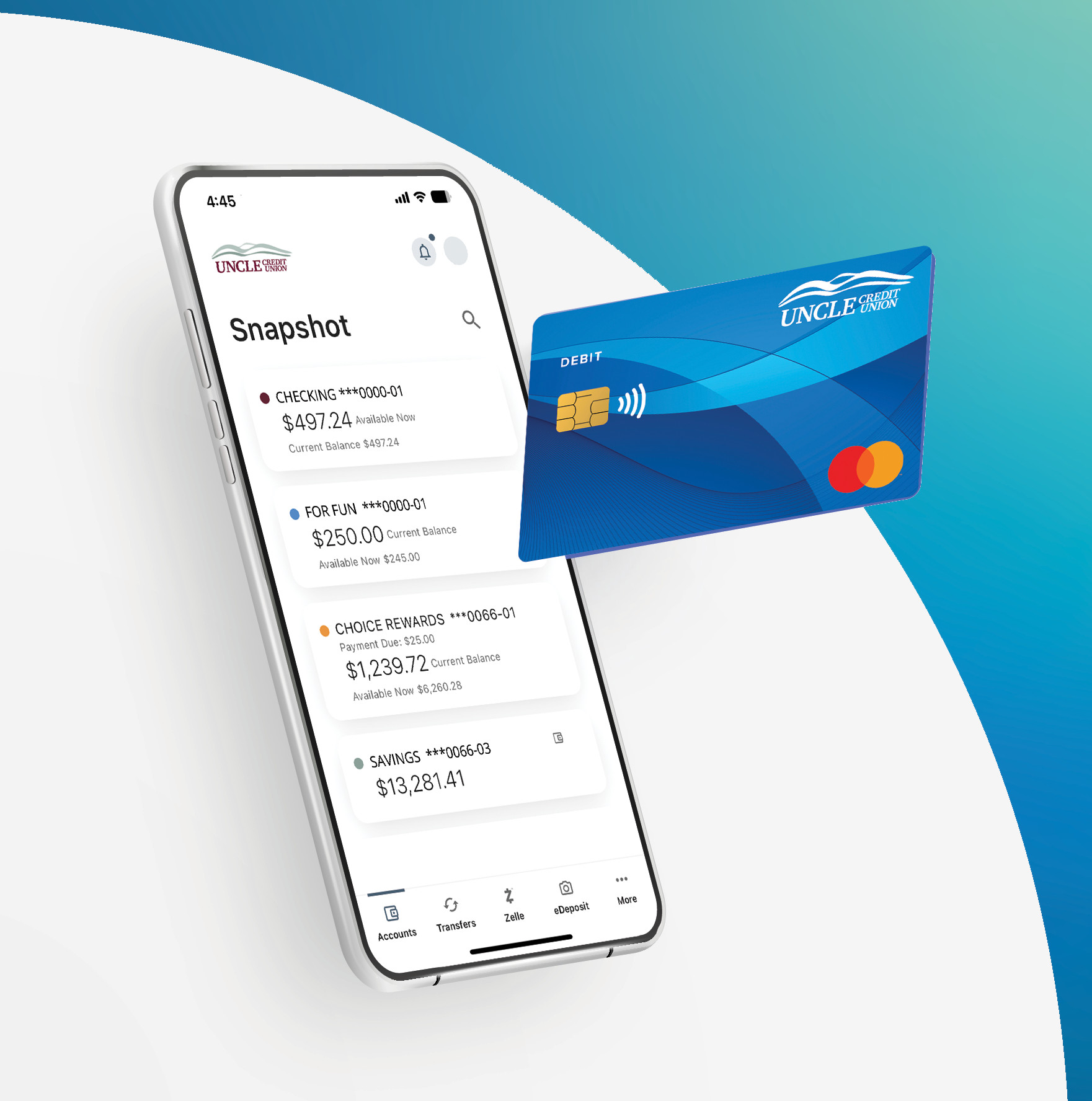

Lost/Stolen UNCLE Credit or Debit Card

To report lost or stolen cards, log in to your online banking and block your card using our Card Management services.

A new card will be issued and mailed to you the next business day after you block the card and report it as lost or stolen. If your account has experienced fraud, block the card as described above, then contact us on the next business day at (925) 447-5001 to find out how to dispute any fraudulent activity.

UNCLE Fraud Prevention Information

-

UNCLE will never contact you via text to approve a transaction or ask for your financial information.

-

UNCLE will never ask for your password or login credentials. If you receive a phone call asking for this information, hang up.

-

UNCLE will always be spelled in capital letters. UNCLE Credit Union will never be written as Uncle Credit Union.

-

Review the UNCLE Fraud Prevention Handbook for more information.